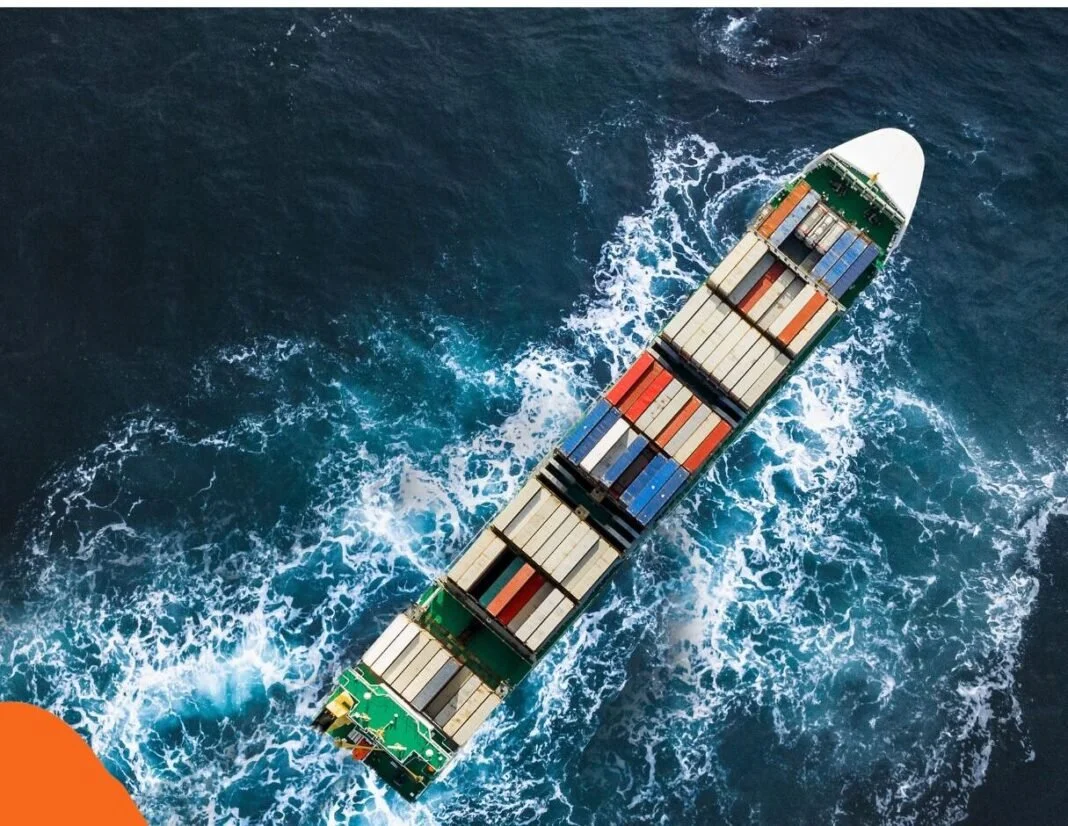

The Future Of Maritime

Zero Wake Fund is a Founder to Pre-Seed fund investing in innovations accelerating maritime decarbonization. We specifically target frontier innovations that are better/cheaper/faster/higher utility than current solutions. Our vision is a vibrant and profitable maritime industry with a dramatically lower carbon footprint.

Our Why

Like many industries today, maritime and the supply chains that rely on it are asking whether the competitive realities of global transportation align with the goal of reducing global carbon footprint.

At Zero Wake Fund, we believe this is a false choice. We believe innovations that reduce the industrial global footprint can also grow revenues, reduce costs, and increase profitability. We see this as a massive, global industrial transformation, creating both venture scale investment opportunities while positively impacting the maritime industries relationship with our natural environments.

In pursuit of this strategy, we are focused on 5 specific areas of innovation: How Ships Are Made, How Ships Move, Fleet Efficiency, How To Handle Cargo, and How To Handle Waste. We approach each of these sectors with a focus on transformational, not incremental, innovation.

Our Focus Areas

How Ships

Are Made

How To Handle Cargo

Fleet

Efficiency

How Ships

Move

How To Handle Waste

Our Team

Brock Mansfield, Managing Partner

Brock has made first round investments in multiple emerging environmental market leaders across such sectors as Waste To Value (Tidal Vision, Bloom Labs) Cell-based Seafood (Blue Nalu), New Materials (Algenesis, Tom Tex), E-Commerce (Public Goods), Circular Economy Brands (Hilos, Simplifyber, Oddli) and Enabling Tech (Matter, Blumen Systems).

He is also founder of EnVest, a collaborative global community of early stage environmental funds committed to working together to accelerate capital behind compelling innovations. As Chairman of EnVest, Brock identifies and selects the companies for the annual EnVest EnVision cohort, which collectively have gone to raise more than $2.0 billion in follow on financing. These selections include market leaders such as Gradient, Carbon Upcycling, Lingrove, Lilac Solutions, Cruz Foam, Terviva, and Moleaer.

Brock is highly engaged in the Stanford climate innovation ecosystem, where he helps accelerate climate and environmental startups coming out of Stanford Climate Ventures, the TomKat Center for Sustainability and the GSB Startup Venture Studio, while also funding post-grad climate innovators as a judge for the $600,000 Doerr School’s Eco-preneurship grant program. He splits his time between the Bay Area and Seattle.

Jean-Noel Poirier, Managing Partner

Jean-Noel is a seasoned climate tech investor and former executive. He has played a pivotal role in investing in early-stage ventures within the climate and sustainability space, initially as an Executive Managing Director at Clean Energy Venture Group and a Venture Partner at Clean Energy Ventures, and later as a member of E8, a top cleantech investor network. He focuses on a broad spectrum of sectors, including clean energy, and aims to drive positive environmental impact through strategic investments and active support.

Before investing, Jean-Noel held leadership roles globally, including co-founding Inventec Performance Chemicals USA and serving as an officer at Global Solar Energy. He also spent seven years at Honeywell International in strategic and leadership positions.

Jean-Noel obtained his MBA from the Kellogg Graduate School of Management, has a lifelong passion for oceans and sailing, and he currently resides in Seattle with his family.

Contact Us